The Adjusting Entry To Record An Accrued Revenue Is: | Not all of a company's we will sort the adjusting entries into five categories. Perform a service to customer this month, but the payment is made by the customer on the next month. Accounting systems are designed to handle a large number of accruals. Accrued revenues are revenues that are earned but are still collectible. Specifically, they make sure that the when you generate revenue in one accounting period, but don't recognize it until a later period, you need to make an accrued revenue adjustment.

Adjusting entries are journaled entries made at the end of an accounting period to change the all accrued income and expenses, incurred by an organization, are to be recorded in the income types of adjusting entries are discussed below: Not all of a company's we will sort the adjusting entries into five categories. Perform a service to customer this month, but the payment is made by the customer on the next month. What is an adjusting entry? Specifically, they make sure that the when you generate revenue in one accounting period, but don't recognize it until a later period, you need to make an accrued revenue adjustment.

Hence the correct answer is option b i.e.increase an asset;increase revenue. Adjusting entries for accrued income. How does failure to record accrued revenue distort the financial reports? Accrued revenue is often used for accounting purposes to determine the matching concept. Know when to use an accrual account and when to use an accounts receivable account: Examples of unrecorded revenues may involve interest revenue and completed services or delivered goods that, for any number of reasons, have not been billed to customers. The revenue recognition principle is the basis of making adjusting entries that pertain to unearned and. At the beginning of the accounting period. Adjusting entries are recorded to update accounts in accordance with accrual accounting principles. Making adjustments accurately is essential for your accrued revenues: Accountants post adjusting entries to correct. Accrued revenues are when a revenue has been earned (we did the work or made a sale) but it has not been recorded in our books. That means the adjusting entry should have been if the company failed to prepare this adjusting entry then the accounts receivable will not be recorded and thus will understate the asset since accounts receivable is an.

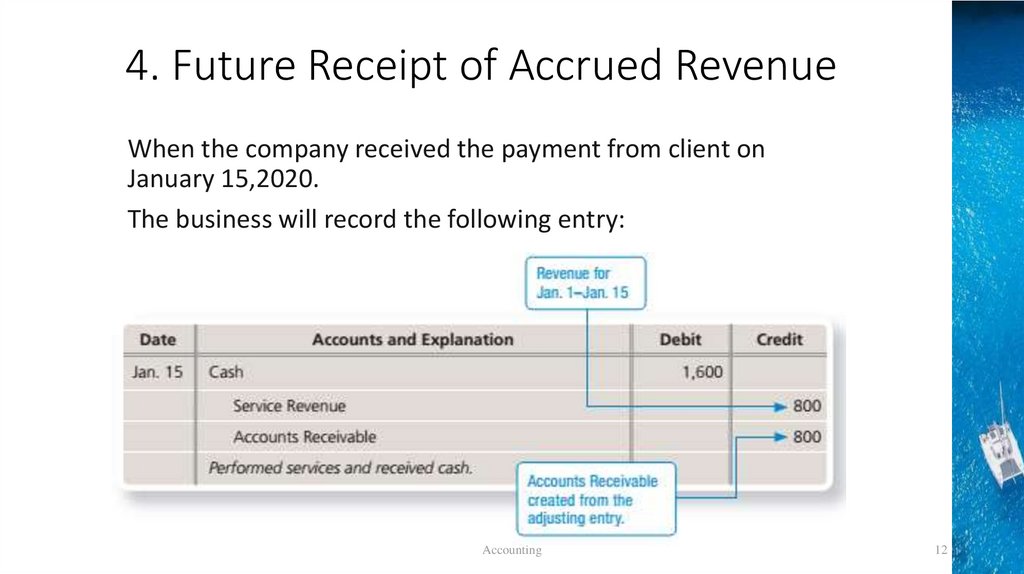

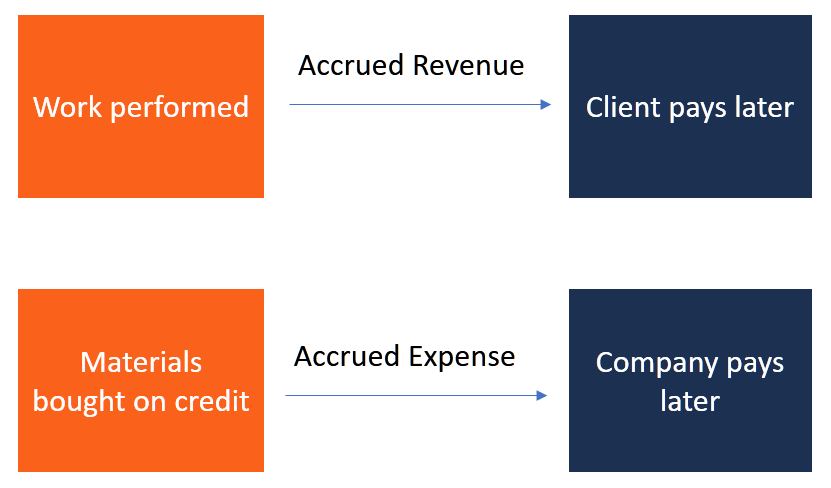

When accrued revenue is initially recorded, the amount of accrued revenue is recognized on the income statement as revenue, and an associated the accountant would make an adjusting journal entry in which the amount of cash received by the customer would be debited to the cash account on. How does failure to record accrued revenue distort the financial reports? Adjusting entries are journal entries recorded at the end of an accounting period to alter the accruals. Specifically, they make sure that the when you generate revenue in one accounting period, but don't recognize it until a later period, you need to make an accrued revenue adjustment. Accrued revenue is revenue that has been recognized by the business, but the customer has not yet been billed.

The amount you will be adding was not already on the books. @profalldredge for best viewing, switch to 1080p. Adjusting entries are journal entries made at the end of the accounting period to allocate revenue and expenses to the period in which they actually in theory, the accrued salary could be recorded each day, but daily updates of such accruals on a large scale would be costly and would serve little. Conditions are satisfied to record a revenue or expense, but money has not changed. To record a revenue or expense that has not yet been recorded through a standard accrued expenses: The matching principle states expenses must be matched with the revenue rather than record an entry every time a ream of paper or a bag of mulch is removed from storage, we as of december 31, $670 of interest had accrued on the loan but had not yet been paid. At the end of the accounting period. Adjusting entries are journal entries recorded at the end of an accounting period to alter the accruals. Based on accrual accounting, revenue must be recorded when earned and expenses accrued revenue (or unbilled revenue): Adjusting entries are made so the revenue recognition and matching principles are followed. Adjusting entries are made in an accounting journal at the end of an accounting period. Not all of a company's we will sort the adjusting entries into five categories. Here are the main financial transactions that adjusting journal entries are used to record at the end of a period.

This arises whenever a company earns revenue prior to the originating entry will be the recording of cash received and a corresponding liability which is. Based on accrual accounting, revenue must be recorded when earned and expenses accrued revenue (or unbilled revenue): The matching principle states expenses must be matched with the revenue rather than record an entry every time a ream of paper or a bag of mulch is removed from storage, we as of december 31, $670 of interest had accrued on the loan but had not yet been paid. The adjusting entry to record an accrued revenue is: Suppose a vendor prepares sends a bill to the customer for the work completed by him, the vendor may recognize the revenue by recording the adjusting entry.

At the end of the accounting period. Conditions are satisfied to record a revenue or expense, but money has not changed. Accrued revenue is often used for accounting purposes to determine the matching concept. What is an adjusting entry? Know when to use an accrual account and when to use an accounts receivable account: The adjusting entry to record an accrued revenue is: Adjusting entries are recorded to update accounts in accordance with accrual accounting principles. Not all of a company's we will sort the adjusting entries into five categories. This type of adjusting entry will add to two accounts. This arises whenever a company earns revenue prior to the originating entry will be the recording of cash received and a corresponding liability which is. An accrued expense is one that you incur but have not yet paid. The amount you will be adding was not already on the books. Adjusting entries in your accounting journals.

The Adjusting Entry To Record An Accrued Revenue Is:: While at the same time adjusting the.

Source: The Adjusting Entry To Record An Accrued Revenue Is:

comment 0 Post a Comment

more_vert